If you are a small business owner with twenty or fewer full-time employees, and you are not a sole proprietorship, there are new federal reporting requirements that are likely to apply to you. The requirements come from the Corporate Transparency Act (CTA), which is sometimes referred to as the beneficial owner law.

Under the law, which went into effect on January 1, 2024, you are required to disclose beneficial owner information (BOI) to the U.S. Government. This report (disclosure) needs to name all the beneficial owners and is in addition to and separate from paperwork you filed to form the business in your state.

Which Businesses Have to File Beneficial Ownership Information Reports?

Although beneficial ownership reporting regulations do not apply to sole proprietorships, they do apply to single-member LLCs, LLPs, one-person corporations, and other very small businesses. In general, your business will need to file a BOI report if it:

- Has twenty or fewer full-time employees.

- Is an LLC, LLP, small corporation, or other business created by registering with a state government.

- Reported $5 million or less in sales on your federal tax return last year.

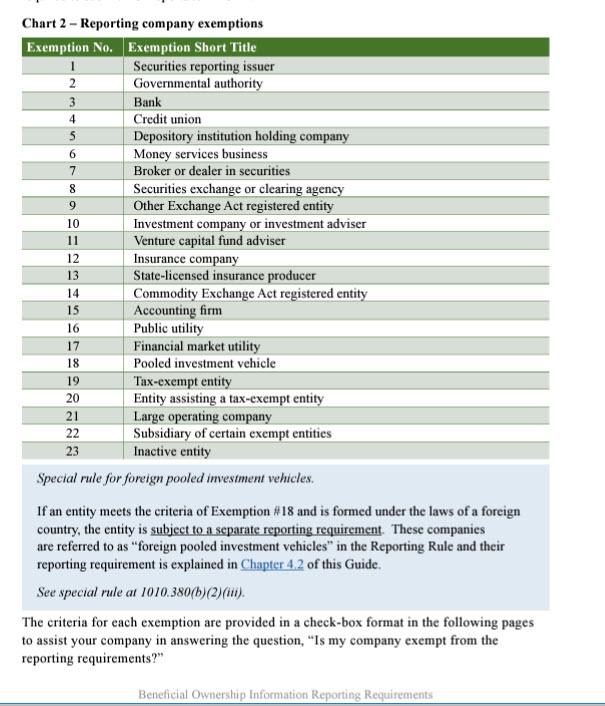

The reporting rules apply to both domestic and foreign businesses operating in the U.S. There are a few special types of businesses that are exempt from filing requirements. See the chart below.

Who is a Beneficial Owner?

A beneficial owner is anyone who has substantial control over or owns a business, even if their name isn’t directly on the paperwork. This includes:

- Individuals who own or control at least 25% or more of the shares or ownership interests in the business.

or

- Individuals who are able to make important decisions on behalf of the business even if they don’t own a majority stake. This could include executives, shareholders, partners, or other individuals with significant over decision-making.

You may also have to report information for “company applicants.” A company applicant is the person (such as your attorney) who first filed documents registering the company in your state. See FinCEN’s FAQ sheet on beneficial owners for more information.

What Information Do You Have to Report?

For each individual who is a beneficial owner, you have to provide the following information:

- The individual’s full name

- Date of birth

- Residential address

- An identifying number from an acceptable identification document such as a passport or U.S. driver’s license, and the name of the issuing state or jurisdiction of identification document. You also have to file an image of the identification document used to obtain the identifying number.

Note: FinCEN’s Small Entity Compliance Guide includes a checklist to help identify the information required to be reported (see Chapter 4.1).

The same information has to be reported for company applicants, too, unless the company applicant is an attorney or corporate formation agent. In that case, the company applicant’s business address in place of the residential address.

How to Report Beneficial Owner Information

You report beneficial owner information online by filing a Beneficial Owner Information Report (BOIR) through the BOI E-Filing System.

As you’ll see, when you get to that page, the BOI E-filing system is run by the Financial Crimes Enforcement Network (FInCEN). FinCEN is a bureau of the U.S. Treasury.

Why Was the Law Enacted?

The Corporate Transparency Act was enacted to help curb money laundering, tax fraud, and other types of financial fraud. Requiring disclosure of beneficial owners makes it more difficult for fraudsters to use small corporations and LLCs to hide their identity from authorities.

When Do You Have to File the Beneficial Owner Report?

According to FinCEN, the reporting deadline depends on the date a “reporting company” was started or registered. (A reporting company is a business that is required to report beneficial owner information.) The deadlines for reporting companies to file reports are as follows:

- If the company was created or registered to do business before January 1, 2024, you have until January 1, 2025, to file its initial BOI report.

- Companies created or registered in 2024 will have 90 calendar days to file after receiving actual or public notice that its creation or registration is effective.

- Companies created or registered on or after January 1, 2025, will have 30 calendar days to file after receiving actual or public notice that its creation or registration is effective.

Are Any Businesses Exempt from Filing BOIR Reports?

Businesses operating as sole proprietorships are exempt from the reporting requirements. Certain other types of businesses are exempt, too. FinCEN list 23 types of exempt businesses in this chart, which appears in their Small Entity Compliance Guide.

Where to Get More Information

You can find more information about reporting on the BOI page on the FinCEN website. Find more information in their compliance guide. Or, check with local resources such as the SBDC or SCORE.

You may also want to consult with your accountant or attorney, particularly if you have questions or concerns about whether you have to file a report and about which individuals you have to report.