Are you thinking about freelancing or some other type of full-time or part-time self-employment? Do you dream of owning a microbusiness that employees a few people in addition to yourself?

Or do you have a product you want to sell into the micro-sized business market?

In these and other circumstances, you’re likely to search the web for statistics about the number of self-employed, homebased businesses, and micro-sized businesses. (A microbusiness has fewer than ten employees.)

Chances are, you’ll be looking for income or earnings statistics for this market, too.

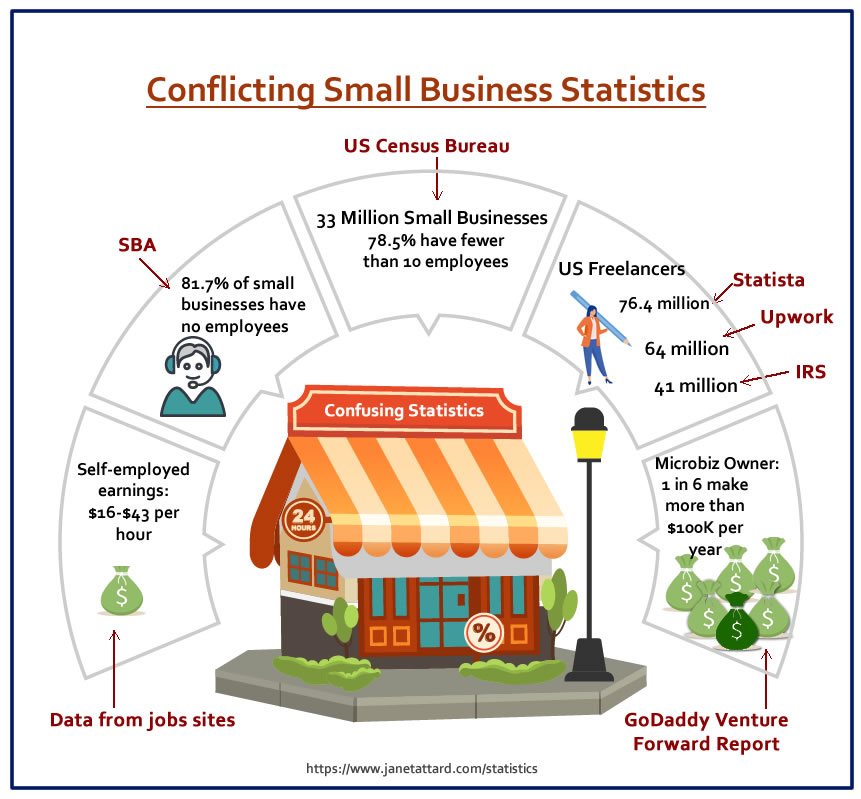

Your search will produce a multitude of reports from government agencies and private organizations that survey, study, and report on small businesses. But as you dig through the results, you’ll discover conflicting data about the number of freelancers, one-person businesses, and microbusinesses. In fact, different U.S. government agencies seem to report conflicting data.

But there is one thing that all the statistics show: self-employment and microbusiness ownership is widespread in the United States.

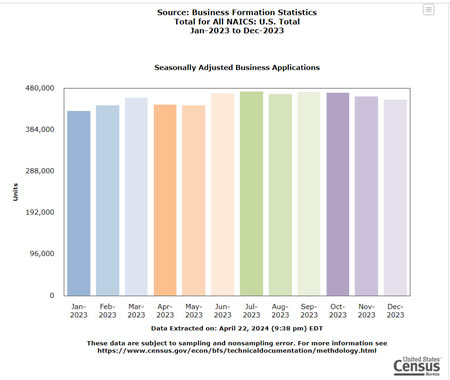

Business Startups on the Rise

Census Bureau data shows a big surge in the number of startups in recent years compared to the past. A record 5.5 million business applications were filed in 2023, which was a 56.7% increase over 2019.

Small and Microbusiness Statistics

Data from the US Census Bureau show that overall, there were more 33 million small businesses in the US in 2020. Of those, 78.5% are microbusinesses with fewer than 10 employees.

Statistics about Businesses with No Employees

The biggest variation in statistics come from data about the self-employed. As you can see here, the numbers all over the place. Even figures from different US government agencies don’t agree.

- A FAQ sheet published by the SBA Office of Advocacy shows that 27 million firms (81.7% of small businesses) have no employees.

- The IRS reports there are 41 million self-employed.

- Data from the Intuit QuickBooks Small Business Index Annual Report, shows the percentage of small businesses with no employees grew from 76% in 1997 to 84% in 2020. Their data suggests self-employment may increase in 2024, as well. The results are calculated from a survey of more than 5,000 small businesses.

- The Upwork Research Institute’s 2023 Freelance Forward survey says there are 64 million Americans (38% of the US workforce) who are freelancers.

- Statista expects there to be 76.4 million freelancers in the US in 2024 and projects that number will rise to over 86 million (half of the workforce) by 2027.

Why Self-Employment and Microbusiness Statistics Vary So Much

One of the reasons for the conflicting statistics is that different studies look at different criteria and gather information from different sources. For instance:

- The US Census Bureau develops its statistics from data collected in the Survey of Business Owners (SBO), which is conducted every 5 years.

- The IRS bases the number of self-employed on data from tax returns.

- Some large corporations and organizations that publish small business statistics work with professional researchers to run surveys and gather data.

- Some private company research is based on analysis of internal databases.

Another factor that makes it difficult to pin down the numbers is that some reports list total numbers, while others only mention percentages.

Overlapping Terms Describing the Self-Employed and Microbusiness

Then, too, terms aren’t exact.

Someone who has incorporated their one-person business may not be counted as self-employed because they are technically an employee of the corporation.

Data on owner earnings from payroll companies won’t include sole proprietor earnings because sole proprietors aren’t salaried. (They get paid by taking a draw against profits.)

Meanwhile a self-employed sole proprietor may have employees and use the payroll company to process their employees’ payrolls.

A microbusiness can be a business with as many as nine employees or a self-employed individual who makes and sells handmade jewelry or candles in their spare time.

And what no one can measure is the underground economy – those people who make a little money “on the side” and don’t report their income (or don’t know they’re supposed to), and the cash-only or cash-preferred businesses that illegally under-report income to save on taxes.

Although the results from published studies differ significantly in some cases, what doesn’t change is the big picture. Self-employment and microbusinesses have a big impact on individual income and on the US economy.

Self-employed and Microbusiness Earnings

How much do self-employed people and microbusiness owners earn? How much can you expect to earn working for yourself?

Here again, the numbers vary. There’s no one-size fits all answer to that question.

ZipRecruiter claims the national average hourly “pay for a self-employed” is $16 an hour in 2024. Meanwhile, Zippia says self-employment pays an average of $40.53 an hour. But the figures from both of companies are based on job postings, not on the amount of money a business makes by finding clients without using a jobs site or by selling merchandise.

PayScale reports the average annual salary for small business owners is $69,838. Their studies show that 10% of small business owners pay themselves less than $30K a year, and that the average annual salary for owners who have been in business for 10 to 19 years is $85,000.

A GoDaddy Venture Forward report released in March 2024 found that one in six microbusiness owners in the US earn over $100,000 a year.

Age, Microbusiness Ownership, and Income

How old are business owners and how does their age relate to income?

There’s no age minimum or limit for running your own business. However, in the US, the majority of self-employed and microbusiness owners are middle aged and up. The Venture Forward study found that 63% of microbusiness entrepreneurs in the US are Generation X (age 40-54) or baby boomers (age 55+).

A study released by Oberlo in 2023 found there was an even larger percentage of small business owners fell into older age groups. Their report found that the average age of small business owners was between 43 and 77, with Generation X and baby boomers accounting for as many as 86.8% (nearly nine out of every 10) of all small business owners.

Furthermore, the study found that older business owners made more money than those who are younger.

Determining Factors for Self-Employed and Microbusiness Earnings

What else, besides age, is linked to the amount of money a person or business makes? Here are the top factors:

- What they do.

- Where they’re located.

- How many hours they work.

- How well they price their products and services.

- How good they are at sales and marketing.

- Whether they continue to work alone or hire employees.

- How long they’ve been in business.

Someone making and selling handmade soaps might average only a couple of thousand dollars a year in profit, or less. A virtual assistant might bring around $50,000 a year.

Someone who sells popular training courses online, or who develops a popular app or game might bring in $100,000 a year or more. (A handful of people have built online training businesses that bring in millions of dollars a year.) And a small IT company may do more than $1 million a year with less than 10 employees.

As the figures suggest, some self-employed and micro-sized business owners can make more money on their own than they could as an employee. Others make a pittance.

What’s Causing the Startup Boom?

Why are startups booming when their potential earnings seem so unpredictable?

The change in lifestyles, work, attitudes toward work brought about by the pandemic is one reason.

Digital tools make it possible to work, learn, and interact with others remotely. Apps, software, and AI streamline some job functions making it faster and easier to complete some kinds of work than in the past.

Layoffs during the pandemic as well as those still happening have led to many people becoming self-employed or starting a microbusiness.

Minimal startup costs for many types of businesses. It’s far easier and less expensive to start many types of businesses now than it was in years past. Your home computer, a multi-function printer, and an internet connection are all that’s need to start some service businesses. Online marketplaces and storefronts make it possible to sell many types of products without having to rent commercial space. Plus they let a microsized business reach customers far beyond their own geographic location.

What’s the Difference Between a Microbusiness, Self-employment, Freelancing, and Gig Work?

A slew of different terms are used to describe one-person and very small businesses. Among the most common are freelancer, independent contractor, self-employed, gig worker, consultant, microbusiness, small business owner, and side-line business.

Each of those designations can have different connotations – and different marketing implications. For instance, to clients, the term small business owner, consultant, or contractor may sound more professional and stable than the terms gig-worker or freelancer.

If you buy or create your own inventory and sell the merchandise in an ecommerce store, terms like freelancer, gig worker, or contractor don’t adequately represent what you’re doing.

But no matter what term you use to describe your work or the nature of your business, the IRS will refer to you as self-employed if you haven’t incorporated the business.

Advantages of Working for Yourself

Whether you work part or full-time for yourself, being your own boss has many benefits. Among them:

- You can choose the kind of work you want to do

- You can choose your own work hours.

- You can work from whatever location you’d like.

- You can perform work the way you think best.

- You may be able to increase your income by a significant amount.

- You can save on the cost of commuting, lunches, and related expenses.

- You can use business expense deductions to save on taxes.

- You experience the satisfaction and pride that comes with being your own boss.

When you consider the benefits and potential earnings, it’s not surprising that so many people want to work for themselves. While it can take time to become successful in your own business, can be a fulfilling undertaking. According to a recent Pew Research survey, the majority of self-employed are extremely satisfied with their job.

Image sources: Infographic compiled from Istockphoto images; Question mark: Deposit photos.